Receiving a bonus, inheritance, or an increase in income often prompts a key financial question: Should I use this money to pay off my mortgage, or invest it?

At first glance, the answer might seem simple. But in reality, it requires careful consideration. Paying off a mortgage can reduce monthly expenses, while investing those funds may create an investment opportunity. What’s best for you depends on a range of factors, including your comfort with debt, cash flow needs, and overall investment strategy.

Although we’re not real estate professionals, we have helped clients think through this decision and developed a framework to guide the conversation. Our goal is to help you make a choice that aligns with your long-term goals and financial priorities.

What to Consider When Paying Off Your Mortgage

There are compelling reasons to reduce or eliminate your mortgage balance. Some are rooted in financial strategy, while others reflect personal values or lifestyle preferences. A few common considerations include:

Emotional and Psychological Benefits

For many, a mortgage is the largest financial commitment they’ll make, and often the one of their highest ongoing monthly expenses.

If carrying long-term debt feels burdensome, reducing or eliminating that obligation can provide a greater sense of control and financial stability. Clients often express that owning their home outright offers a level of clarity and confidence in their overall financial picture. This can be particularly meaningful for those approaching retirement, when managing fixed expenses becomes a greater priority.

Adding It Up

Paying off your mortgage reduces the total interest you’ll pay on that loan over time, especially in the early years, when interest is a larger portion of your payment.

Since a mortgage tends to be a large loan that can last for decades, paying off the loan early may save you thousands of dollars in interest.1

For example, if you borrow $320,000 for your home at 6.6 percent on a 30-year mortgage, you’ll pay $320,000 in principal plus $415,734 in interest, for a total of $735,734 over the life of the loan.2

Another strategy is to consider refinancing at a shorter duration. In the above example, your monthly payment of principal and interest for a $320,000 loan at 6.6 percent would be $2,044. If you refinanced to a 15-year mortgage at 5.9 percent, your monthly payment would rise to $2,683, but you’d only pay $162,956 in interest throughout the loan, saving a total of $252,779 in interest.2

If you are unable to pay off your entire mortgage, you can still save on interest by paying extra principal when you have the cash if your lender allows this option. You may be able to lower the interest paid and the time it takes to pay back your mortgage if you apply extra payments directly to your principal balance.3 Make sure you indicate on your payment slip that the extra amount is to be applied to the principal.

Other Considerations Before Paying Off Your Mortgage

Before considering paying off your mortgage, you might want to check up on your emergency savings and retirement accounts. You also might want to think about prioritizing paying off any high-interest debt, such as credit cards or auto loans, where the interest rates can exceed those of a mortgage.

Additional factors to take into account include:

Higher mortgage rates: Compare your current mortgage rate to the return you might reasonably expect from a low-risk investment, such as a certificate of deposit (CD). According to Forbes, as of July 2025, the best one-year CD rate was 4.40 percent.⁴ A CD is a short- or medium-term debt investment offered by banks and savings and loans. CDs can also be purchased through most brokerage firms and are insured for up to $250,000 by the FDIC.

Preference for certainty: If you value a predictable, recurring monthly budget over the uncertainty of market-driven returns, putting extra cash toward your mortgage may align with your financial preferences.

Approaching retirement: For those nearing retirement, managing fixed monthly obligations can support a more flexible and sustainable retirement strategy.

Before making a final decision, be sure to consider the following:

Prepayment penalties: Some mortgage agreements include fees for early or additional payments. It’s important to review your mortgage terms to determine if penalties could offset some of the benefits of early repayment.

Potential home sale: If you’re preparing to sell your home, any benefits from prepaying may not be realized. In such cases, you might want to consider other options.

Could Investing Extra Cash Be the Smarter Financial Move?

While eliminating your mortgage and owning your home outright can be appealing, there are situations where investing surplus cash may be worth considering.

Long-Term Investing

If your interest rate is low—say around 3 percent, there are pros and cons to putting any extra cash toward your mortgage while continuing to pay your lower-interest mortgage.

U.S. stocks, as represented by the S&P 500, an unmanaged stock market index that is considered representative of the overall U.S. stock market, have had a long-term average annual return of about 10.5 percent since the index was updated in 1957 to include 500 stocks.6

A portfolio composed of 60 percent stocks and 40 percent bonds has an average annual return of around 8 percent over the past 90 years. In this illustration, bonds are represented by the Bloomberg US Aggregate Bond Index.7

Of course, past performance is no guarantee of future results. And individuals cannot invest directly in an index. If you sell a bond prior to maturity, it may be worth more or less than the original price paid.

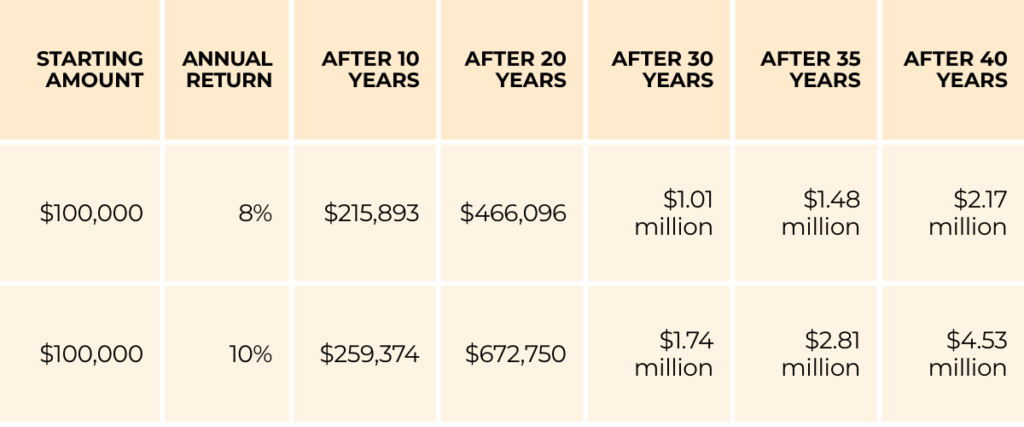

Compound Growth

When investing, you allow your money the opportunity to grow over time. As the table below illustrates, if you received a hypothetical return of 8 percent or 10 percent on a $100,000 investment, the power of compounding has the power to work for you over longer periods of time.8

Opportunity Cost

Economists have a phrase called, “opportunity cost.” It’s a simple but powerful idea to understand. It means the potential benefit that is lost when choosing one alternative over another. In this instance, the potential benefit that is lost by choosing to use the money to pay off a mortgage rather than pursue an investment opportunity. And vice versa.

Leverage and Capital Efficiency

Another consideration is how mortgage debt works. A home’s value typically fluctuates based on market conditions, not on how much equity the owner has in the property. That means its market value may or may not reflect whether the house is fully paid off or leveraged.

How Does Paying Off Your Mortgage Early Affect Your Taxes?

There may also be tax implications when paying off your mortgage early.

The federal mortgage interest deduction allows taxpayers who itemize to deduct interest paid on up to $750,000 of eligible mortgage debt if married and filing jointly. The deduction also applies to interest on home equity loans, provided the funds are used to buy, build, or substantially improve the property. For mortgages originated after October 13, 1987, and before December 16, 2017, interest may be deductible on up to $1 million of eligible mortgage debt. There is no cap on the interest deduction for loans originated on or before October 13, 1987. This benefit is only available to those who itemize deductions rather than take the standard deduction.¹⁰

In addition, legislation passed in 2025 temporarily raises the state and local tax (SALT) deduction cap from $10,000 to $40,000 per household for tax years 2025 through 2029. The expanded deduction begins to phase out at $500,000 of income in 2025, and the cap is scheduled to return to $10,000 in 2030. This change may benefit homeowners in high-tax states, where deductible state and local taxes often exceed the previous limit.

It’s important to note that paying off your mortgage may limit your ability to deduct mortgage interest. We can provide you with additional information on the new tax laws, but we would encourage you to speak with your tax professional before making any changes.

Today’s Mortgage Rates

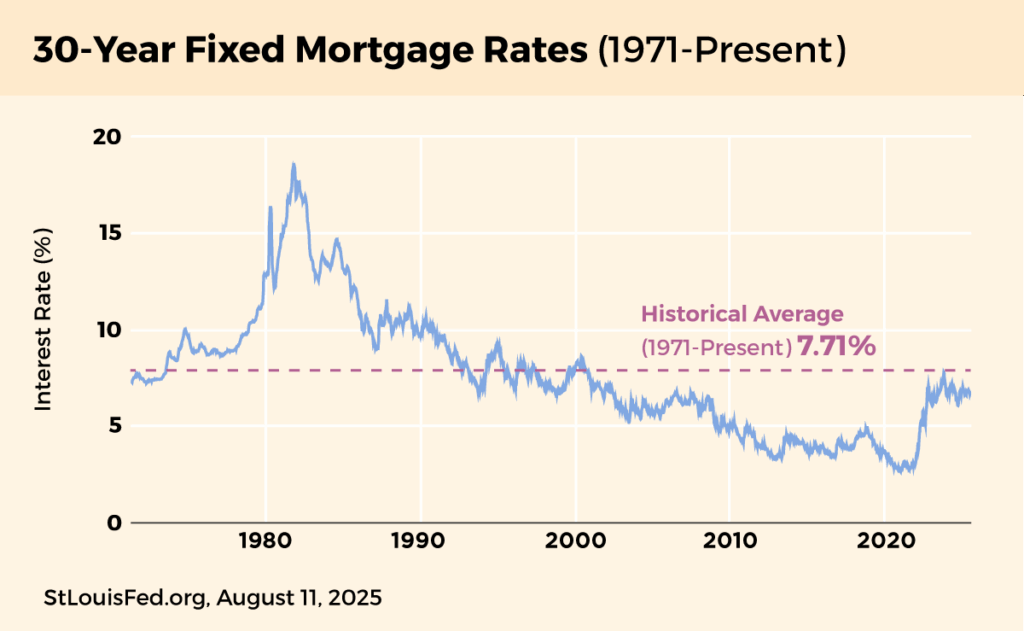

Mortgage rates may feel elevated today, but from a historical perspective, they remain in line with what many homeowners have paid over the past decades. Since Freddie Mac began tracking rates in April 1971 through July 2025, the median 30-year mortgage rate is 7.71 percent.11 However, it’s true that rates in 2025 above 6.5 percent are higher than the 4.5 percent average rate over the past decade.12

What Personal Circumstances Impact the Mortgage Payoff Decision?

Since there are no strict rules, deciding whether to pay off your mortgage depends on your personal preferences, including:

- Emergency Reserve: Are you comfortable with the amount you’ve put aside for emergencies? You may want to have at least 3–6 months of liquidity.

- Debt Priority: How much other debt are you carrying each month? It may be best to pay high-interest debt before your low-rate mortgage.

- Income Outlook: How is your employment outlook? Stable employment can support investing, where instability might suggest caution.

- Risk Tolerance: How much risk are you comfortable with? Some people prefer being debt-free over other choices.

- Life Stage: What stage of life are you in? Younger individuals have different priorities than those nearing retirement.

What’s the Best Way to Balance Paying Down Your Mortgage?

Paying off your mortgage and investing don’t have to be mutually exclusive. A hybrid strategy may offer the best of both worlds for those looking to manage debt while pursuing investment opportunities. This approach may give you flexibility based on your risk tolerance and time horizon.

- Split Approach: You can use half the extra cash to pay down at least part of your mortgage while pursuing investment opportunities with the other half.

- “Ladder” Approach: If you have the discipline, another option is to alternate payments—paying the mortgage one month and investing the next.

Decision Framework: How to Choose

Consider using the following decision-making framework to help weigh the trade-offs and determine which option—or combination—is most aligned with your long-term goals. As we mentioned earlier we’re not real estate professionals, but we have helped clients think through this decision.

- Calculate your after-tax mortgage rate, including deductions

- Estimate expected investment returns, factoring in risk tolerance and costs

- Assess your liquidity needs, including your base budget and expected large expenses

- Align with your goals and timeframes, then compare options

- Choose an approach—pay off your mortgage, invest the assets, or go with a hybrid approach

What’s the Interest Rate of Your Current Mortgage?

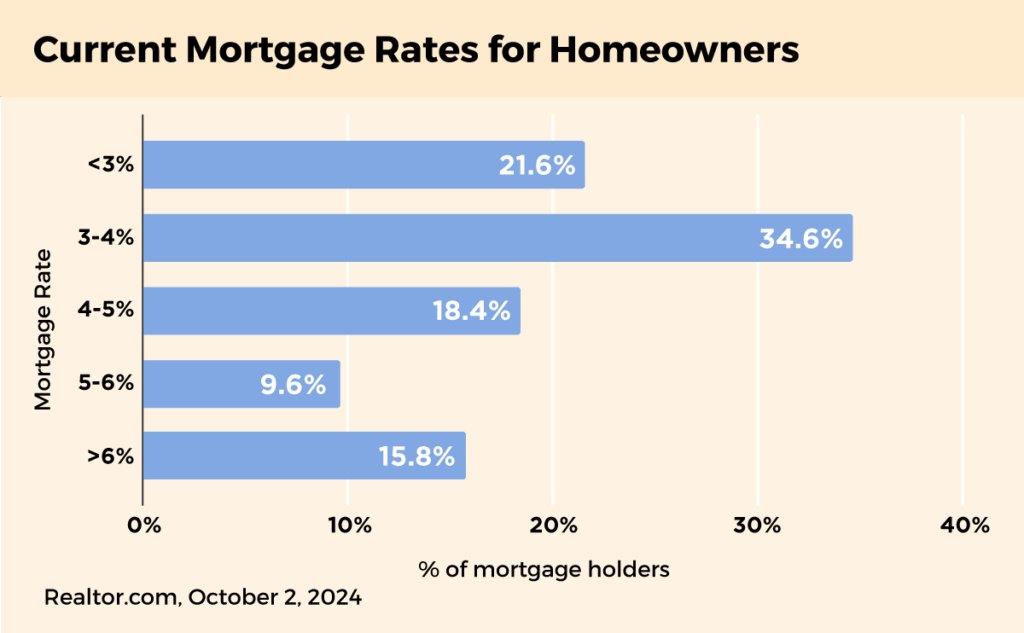

One factor that is driving some people to consider paying off their mortgages, or at least refinancing, is the rate they are currently paying. Since mortgage rates fluctuate constantly, your number is based on the rate environment at the time you purchased your house.

As you can see, while most homeowners have mortgage rates of 4 percent or less, a number are still paying more.13 Where do you fall?

If you are still unsure about how to deploy your extra cash, think about whether you might fall into one of these three categories:

- 3 percent mortgage, long horizon, and/or comfortable with market volatility

- 6 percent mortgage, risk-averse, and/or close to retiring

- 4 percent mortgage, balanced goals, and/or reluctant to commit

Having a Well-Rounded Financial Strategy

There’s no one-size-fits-all answer to whether to pay off your mortgage early or invest. The right choice depends on various factors: your mortgage rate, tax situation, employment outlook, time horizon, and overall comfort with risk. Both strategies can support your financial goals, but they should be considered within the context of your broader financial approach.

As financial professionals, we’re here to help you evaluate your options and build a strategy that reflects your priorities and goals. If you’d like to explore what makes the most sense for your situation, we invite you to start that conversation with us.

Sources

1. Forbes, September 28, 2023

https://www.forbes.com/advisor/mortgages/pay-off-your-mortgage-early-zx1fa

2. AARP, May 21, 2025

3. Chase, July 2025

https://www.chase.com/personal/mortgage/education/owning-a-home/paying-extra-on-mortgage

4. Forbes, July 15, 2025

https://www.forbes.com/advisor/banking/cds/best-1-year-cd-rates

5. NerdWallet, April 10, 2025

6. Business Insider, January 2, 2025

https://www.businessinsider.com/personal-finance/investing/average-stock-market-return

7. Wealthy Education, July 2025

https://wealthyeducation.com/60-40-portfolio-historical-returns/

8. Bankrate, March 18, 2025

https://www.bankrate.com/investing/how-to-invest-100k

9. The Wall Street Journal, September 10, 2024,

10. Bankrate, June 6, 2025

https://www.bankrate.com/mortgages/mortgage-interest-deduction

11. The Mortgage Reports, July 18, 2025

https://themortgagereports.com/61853/30-year-mortgage-rates-chart#historical

12. U.S. News & World Report, March 21, 2025

https://money.usnews.com/loans/mortgages/articles/historical-mortgage-rates

13. Realtor.com, October 2, 2024

https://www.realtor.com/news/trends/majority-americans-still-feel-locked-in-by-mortgage-rates