Key Takeaways

- Year-end holidays may be a good time to initiate a discussion about financial matters that may impact your family.

- If you have adult children, you may want to discuss your financial situation, estate strategy, and legal preparations for the future with them.

- Your financial situation can include your sources of income, how you pay your bills, the passwords you use to access your financial information, where your accounts are kept online, and who makes up your team of financial, legal, and tax professionals.

- Review your strategy, values, and philosophy around money and investing for your estate discussion. Talking about your estate strategy with your adult children is especially important if your estate includes more complex or emotionally sensitive elements.

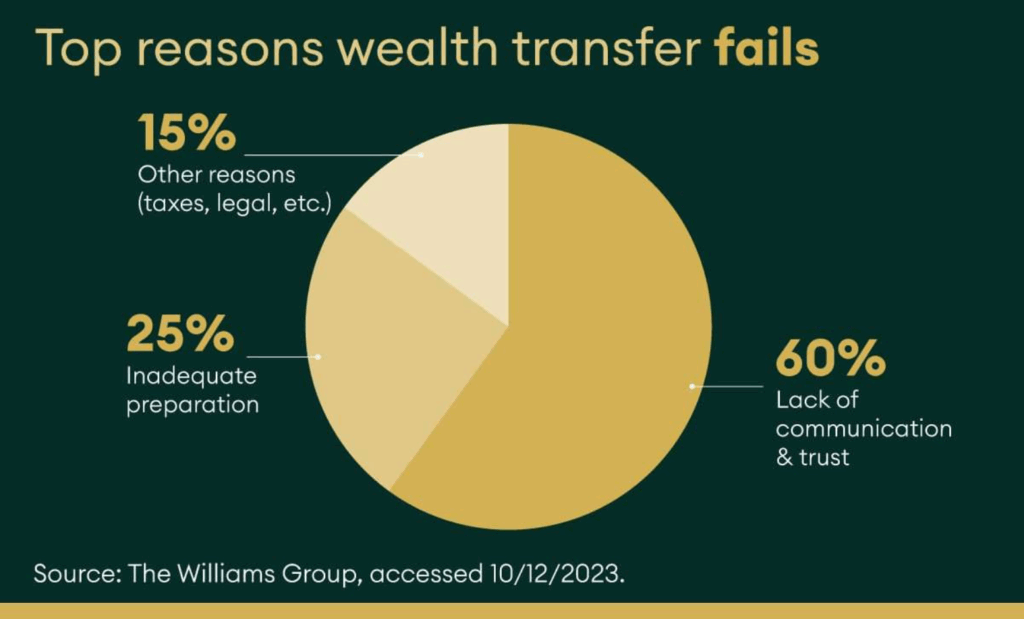

- For the majority of families in the study, the next generation failed to maintain the wealth they inherited. In most cases, the failure to sustain multi-generational wealth was traced back to a lack of communication and trust within the family, followed by a lack of preparedness.

Why Talk About Money During the Holidays?

As you gather with family around the holidays, it may be a good opportunity to discuss a potentially uncomfortable, but necessary topic: family finances. This is especially true if you are older and have adult children who need to be brought up to speed on your financial situation, estate strategy, and legal preparations for the future.

Getting your affairs in order and having a strategy for what will occur after you are gone is one of the greatest gifts you can give those you care most about. Taking some time out of your family’s year-end festivities to have an open, honest, and productive conversation about financial matters may be a good way to start what should be an ongoing process.

What Financial Information Should You Share With Adult Children?

While some families are extremely open about discussing their finances, many others never talk about money, even with their adult children. Maybe they feel it’s too private and none of their business. Perhaps they believe that any financial discussion could create tension, which is why they procrastinate. They may also think discussing mortality would be too disturbing, leading them to avoid the topic entirely. But regardless of the reason, keeping your children in the dark can lead to greater stress for everyone.1

As financial professionals, we have seen both sides. What we’ve learned is that families who take the time to talk through financial issues tend to have more stability during periods of grief. On the flip side, families who don’t discuss finances are often left to navigate uncertainty, conflict, and other issues without any preparation.

That’s why, as hard as it may be, involving your children in your financial strategy is more than practical; it’s a powerful way to manage your legacy and help give your loved ones clarity when it matters most.

Here is some financial information you may want to share:

- Income Sources

If you don’t want to share your exact income, your children should know where it comes from, especially if you are retired. By at least making them aware of the sources of your income stream, you give them early insight into your financial situation.2 - Bill Pay

We all have our own preferred way of paying our monthly bills. Your spouse and adult children need to know how you do it in case someone needs to take over. Are most of your bills paid automatically each month, and if so, from which of your accounts? Do you pay bills through your online banking app when they come in? Or are you writing and mailing checks? Providing these details in advance, in a simple, clean way, can eliminate problems down the road.2 - Passwords

Passwords and usernames are often tricky to remember, so imagine your spouse or adult children trying to figure them out in an emergency. You don’t need to hand them the list now, but you should consider having either a password manager or a typed list that they know how to access if needed.2 - Digital Footprint

Much of your financial information is likely stored online rather than in paper form. If you receive financial information electronically, consider choosing a trusted family member to understand the details of the information, its digital storage, and how to access it.2

- Your Team

If you have a team of professionals who help you with your finances, including a financial professional, an accountant, and an attorney, your adult children should at least know who they are and how to reach them. You should provide these professionals with your children’s names and contact information and specify what information is authorized to be discussed. Arranging a meeting to introduce everyone in person may also be a good idea.2

How to Talk About Estate Preparation With Family

Along with managing our clients’ investment portfolio and retirement savings, helping clients consider the pros and cons of an estate strategy is one of the most important services we provide as financial professionals. We can act as the quarterback of your estate team, coordinating activities with your attorney, tax professional, and others to help keep everyone on the same page.

Year-end is an opportune time to review your strategy on what to leave behind. It’s also a good time to reflect on how your assets will be distributed among your loved ones or charitable causes, and to make certain your approach remains aligned with your values and priorities.

Many of our clients aim to transfer their wealth for future generations, but statistics show that a successful transfer is easier said than done. According to a study by the Institute for Preparing Heirs, only 30 percent of high-net-worth families successfully transfer their wealth.3

The Reasons Wealth Transfer Fails

The Institute for Preparing Heirs concluded that success was connected to families retaining control of their inherited assets. For the majority of families in the study, the next generation failed to maintain the wealth they inherited. In most cases, the failure to sustain multi-generational wealth was traced back to a lack of communication and trust within the family, followed by a lack of preparedness.3

Why Wealth Transfers Often Fail

Squandering an inheritance is nothing new. In 1877, when railroad magnate Cornelius Vanderbilt died, he left an estate worth an estimated $200 billion in today’s dollars. In less than 50 years, most of the money was gone. And while you might not have Vanderbilt money, U.S. households are projected to transfer $124 trillion to heirs and charities over the next two decades. Do you want your piece of that to last for generations?4

The more you can incorporate family communication into your overall estate strategy, the better your chances of your assets passing down to your loved ones according to your wishes. If you are going to meet with your family during the holidays, why not take advantage of the opportunity to start these conversations? Here are some topics to consider.

- Your Overall Strategy

How much do you estimate you will be leaving to heirs? How will you divide the assets between heirs, and why? What are the roles and responsibilities of your family members? If your family doesn’t fully understand your reasons and intentions, you could be setting them up for avoidable conflicts down the road.3 - Your Values

When you meet, explain the values that guide your financial goals. Is your family open to your approach? You may want to create a mission statement to summarize your wishes and why they are important to you. You can even involve your heirs in creating a family mission statement so that everyone can contribute ideas.3 - Your Investment Philosophy

If you have an overarching investment philosophy, share it at the meeting to give your family a frame of reference about your thoughts on finances and investing. This can include a focus on the specific goals as well as the best practices you’ve learned over the years.3

Having estate strategy discussions with your adult children is especially important if your estate includes more complex or emotionally sensitive elements. This is when a lack of clarity and misunderstanding can result in unnecessary expenses, missed opportunities, or even damaged relationships. A few examples:

- Large Pre-tax Retirement Accounts

Under current IRS rules, most non-spouse heirs must fully withdraw inherited retirement plans within 10 years. Having conversations in advance can give you time to consider strategies to help manage the inheritance process.1 - Family Trusts

If you have set up a trust (or are considering it), your children need to understand who the trustees are, how distributions work, and what their responsibilities or limitations might be. Involving them now may help manage any confusion and build accountability across generations.1 Remember, there are many types of trusts, each with pros and cons. Using a trust involves a complex set of tax rules and regulations. Before moving forward with a trust, consider working with a professional familiar with the relevant laws and regulations. - Sentimental Real Estate

Whether it’s a long-standing vacation home or the family house, real estate can have deep emotional ties. Discussing in advance whether your children intend to keep, sell, or rent out the property, and how exactly that will work, can help guide decisions after you’re gone.1 - Business Succession Strategies

If you are a business owner, conversations around the future of the business after you are no longer here are crucial. Do your children want to be involved in running the company? If so, how much time and energy is required? Failing to address these issues in your estate strategy can create fractured ownership, disputes, or rushed decisions. If your business has staff or vendors, it could leave them in a difficult situation. Engaging your children now lets you align expectations and successors while you’re still here to guide the process.1 - Blended Families or Unique Family Dynamics

If you have stepchildren, second marriages, or estranged relatives, estate strategies can be even more complicated. Having clear intentions and communicating them openly may help manage conflict when the time comes.1

Regardless of the size and complexity of your estate, early communication allows your team of professionals to design a strategy that reflects your goals, helps anticipate potential unintended consequences, and puts your family in a position for success.

What Legal Documents Do Families Need?

An important part of your financial discussion with your family should include a review of the legal paperwork you have in place, or intend to get in place. Remember, any estate can benefit from a will and an estate strategy.

Through our experience, we believe there are three foundational documents every adult needs to have in place: a will, a financial power of attorney document, and a medical power of attorney document.5

What Are the Main Purposes of a Will?

- A will provides for a general distribution of your assets through a probate court proceeding at your death. Wills are familiar, straightforward, and relatively inexpensive to create. You will need to choose an executor who will be responsible for carrying out the provisions in your will. Unless you are looking to make a dramatic will-reading scene like in the movies, you should consider discussing the contents of your will with your heirs so there are no surprises.

- If you have more complicated finances or substantial wealth, you may want to consider more advanced estate strategies, which can include creating a trust.5

What Is a Financial Power of Attorney?

- A financial power of attorney (POA) allows you to designate someone to oversee your finances if you cannot physically or mentally do so yourself. This person, known as your agent, can step in and pay your bills or handle other financial matters.6

- Your agent listed on your POA can be a trusted friend or family member. Sometimes, a financial POA can be used for one-off situations where it is not convenient for you to be present, such as a real estate closing in another city.6

What Is a Medical Power of Attorney?

- A medical power of attorney, also known as a healthcare proxy, is a legal document that designates an individual to make medical decisions for you if you are no longer able. As with your financial POA, the person you choose to make healthcare decisions on your behalf is referred to as your agent.6

- This may be needed temporarily (if, for example, you’re under anesthesia and surgery complications arise) or for navigating a longer-term health issue. The medical power of attorney will only go into effect when you do not have the capacity to make decisions for yourself regarding medical treatment.6

During your family sit-down, discuss who you have designated as your will’s executor and agents on your POAs, and explain what you anticipate will happen if and when the time comes.

Make sure the original documents are somewhere safe, and that your executor or trustee knows where to find them. Also, consider providing the executor with the contact information for all of your financial professionals.

Do Beneficiary Designations Override Wills?

Yes! Beneficiaries on retirement accounts, investment accounts, and insurance policies supersede other documents. You should regularly review your beneficiaries and contingent beneficiaries to see if they account for marriages, divorces, new children, or new grandchildren.6

- Set Clear Objectives

- Define the purpose of the meeting. Determine if your primary focus is estate strategy, wealth transfer, budgeting, financial responsibilities, etc.

- Define the purpose of the meeting. Determine if your primary focus is estate strategy, wealth transfer, budgeting, financial responsibilities, etc.

- Choose the Right Time and Place

- Pick a neutral, comfortable, and distraction-free location for the gathering. Be careful to schedule the meeting at a convenient time when everyone can be fully present and engaged.

- Pick a neutral, comfortable, and distraction-free location for the gathering. Be careful to schedule the meeting at a convenient time when everyone can be fully present and engaged.

- Prepare in Advance

- Bring copies of your relevant documents (e.g., wills, trusts, budgets, or investment summaries).

- You know your family, so you may be able to anticipate questions, concerns, or pushbacks. Take some time to prepare thoughtful responses.

- Start with Transparency and Empathy

- Begin the meeting with an overview of why the conversation is important to you and the family.

- Begin the meeting with an overview of why the conversation is important to you and the family.

- Cover Key Topics

- Values and Goals: Share your financial values and long-term goals for the family.

- Financial Overview: Provide an overview of your financial situation, including your assets, liabilities, and income sources.

- Estate Strategy: Discuss wills, trusts, power of attorney, and healthcare directives. If you have a written estate strategy, share that as well.

- Expectations and Responsibilities: Clarify roles, such as executor duties, POA designees, and expected caregiving responsibilities.

- Encourage Open Dialogue

- Make it a no-judgment zone by allowing everyone to ask questions and express their thoughts and feelings.

- Be patient and listen closely to what your children have to say.

- Involve Professionals

- Consider inviting your financial professional, estate attorney, or other relevant professionals to help answer questions and guide the conversation.

- Consider inviting your financial professional, estate attorney, or other relevant professionals to help answer questions and guide the conversation.

- End with Actionable Steps

- Document the key takeaways and decisions made during the meeting.

- Document the key takeaways and decisions made during the meeting.

When Is the Best Time to Hold a Family Financial Discussion?

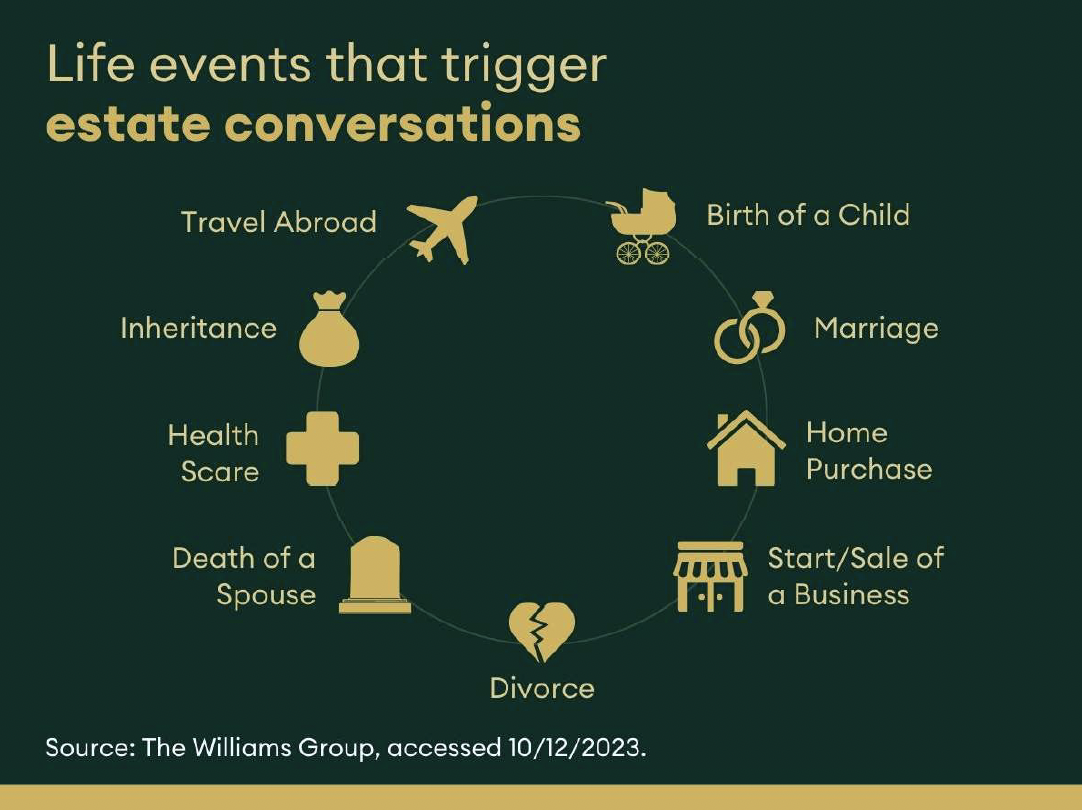

While year-end holidays may be a good time to start a financial discussion because more generations may be in the same location, you can schedule a meeting at any time. A logical time to have your initial financial get-together, or a follow-up, may be when there is a change in the family, as shown in the chart below.7

We Are Here to Help

If you approach your financial discussion with empathy, clarity, and preparation, you can create a positive and productive environment that provides information, addresses issues, and hopefully strengthens family bonds.

We are here to help. If you have any questions about what was covered or would like us to participate as a facilitator at your meeting, please do not hesitate to contact us.

1Forbes, June 25, 2025 https://www.forbes.com/sites/raulelizalde/2025/06/25/why-you-must-involve-your-adult-children-in-your-financial-plan/

2AARP, August 2, 2023 https://www.aarp.org/money/personal-finance/sharing-financial-information-with-adult-children/?msockid=37a2e58496ac672b39a4f4af9742667d

3Vanguard, August 2025 https://investor.vanguard.com/wealth-management/family-legacy-services/knowledge-center/preparing-wealth-transfer?utm_source=chatgpt.com

4Charles Schwab, August 14, 2025 https://www.schwab.com/learn/story/how-to-create-family-wealth-mission-statement?msockid=37a2e58496ac672b39a4f4af9742667d

5MarketWatch, April 3, 2025 https://www.marketwatch.com/story/as-a-72-trillion-great-wealth-transfer-is-set-to-begin-here-are-4-estate-planning-rules-to-follow-19e637be?utm_source=chatgpt.com

6Investopedia, February 2, 2025 https://www.investopedia.com/articles/managing-wealth/042216/medical-vs-financial-power-attorney-reasons-separate-them.asp

7Kitces, June 11, 2025 https://www.kitces.com/blog/estate-planning-advisors-movtivate-clients-logistic-emotional-roadblock-assets-legal/